tsp overview

The TSP is similar to non-government retirement plans offered by private corporations. An optional, tax-deferred retirement savings and investment plan – it is administered by the Federal Retirement Thrift Investment Board.

As a Federal employee, TSP enables you to save part of your income for retirement while receiving matching contributions from your federal agency employer.

Under certain circumstances, you can choose to transfer all or part of your tax-deferred TSP contributions to a specific privatized account.

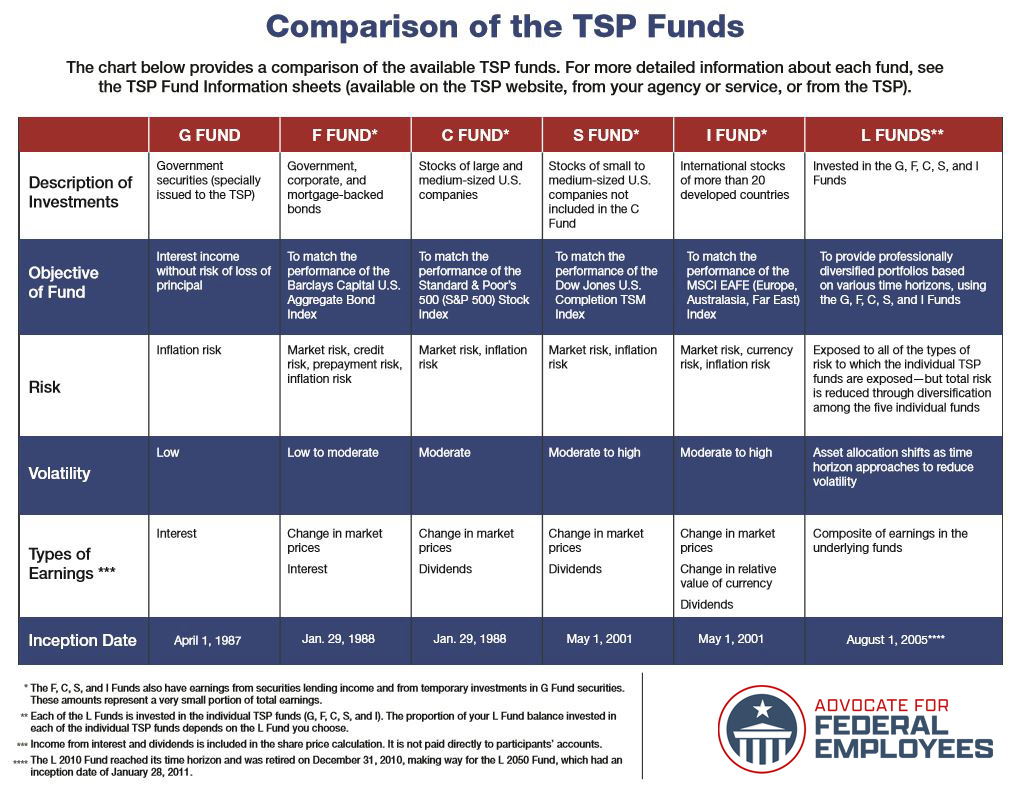

We encourage you to get in touch with a knowledgeable AFFE Representative regarding this matter. Click the graphic on this page for a larger view, or read on for more TSP information!

Thrift Savings Plan

According to the TSP.gov website, there are two types of employee contributions with this savings plan: Regular employee contributions, which include automatic enrollment contributions, and “catch up” contributions for employees aged 50 and older.

Participation in TSP is optional – however if you are a FERS-eligible employee hired after July 31, 2010, you are now automatically enrolled in TSP. Even if you choose not to participate, the government deposits 1% of your income automatically into your TSP account.

You can elect to contribute more to your account and you’ll receive matching contributions on the first 5% of your contributions from the federal agency you work for.

If you’re a federal employee covered under the CSRS plan, you can elect to establish a TSP account but your tax-deferred contributions will not be matched by the government. Keep in mind, the IRS places limits on the tax-deferred contributions you can make to your TSP.

Via the National Active and Retired Federal Employees Association (NARFE), one of the top mistakes federal employees can make is missing the opportunity to contribute to their TSP.

Get a comprehensive, free overview for FERS employees outlining what you need to know about the Thrift Savings Plan and optimizing your retirement income.

Secure Your Future with Protection Plus

Planning for retirement is one of the most significant financial milestones in life, and having a trusted partner to navigate this journey is essential. At Protection Plus Insurance, we are dedicated to helping retirees and their families achieve financial security, maintain their lifestyle, and create a legacy for future generations.

Contact Us Today

Don’t leave your retirement to chance—take control of your financial future today. Contact Protection Plus Insurance for a free consultation and expert guidance on your retirement planning. Call us at (858) 352-6535 or send an email to glenn@protectionplusins.com to schedule your appointment. Let us help you build a secure and prosperous retirement!